Our purpose and strategy

Our purpose is Helping Britain Prosper.

What is the Voluntary Carbon Market (VCM) and how can it help reduce or remove greenhouse gas emissions, and direct funds to critical areas?

Since the Paris Agreement in 2015, there has been marked progress to transition to the low carbon future we need. However, despite notable efforts worldwide, the emissions gap is not closing fast enough. The latest UN1 report indicates that current climate pledges would put the world on course for a temperature increase of 2.6 – 3.1°C this century. 1

The science is clear: the world must reduce emissions to near zero and invest in carbon removal solutions to address what cannot be reduced. The Voluntary Carbon Market (VCM) offers a practical way for organisations to take immediate action now and complement their abatement activity.

Available to companies of all sectors and sizes,2 the VCM directs funding towards projects that support the climate transition by reducing, avoiding or removing greenhouse gas (GHG) emissions. In doing so, it helps mobilise capital, scale up the development of transition technologies and further accelerate progress to net zero.3

However, the VCM is not without its challenges. Concerns raised relate to the integrity of the projects that generate the carbon credits, such as their environmental credibility, and whether they deliver measurable and credible outcomes.4

In the conversations we’re having with our clients, the VCM is increasingly coming up as a topic of interest and an area where clients are seeking support. We see financial services playing a critical role in supporting the integrity of the VCM by providing expertise, resources and the necessary market infrastructure to boost its role in addressing climate change impacts.

The landscape has improved considerably over the last twelve months with the introduction of the Integrity Council for the Voluntary Carbon Market (IC-VCM)’s Core Carbon Principles, and the Voluntary Carbon Markets’ Integrity Initiative (VCMI)’s Claims Code of Practice – two new standards that aim to improve the quality of credits supplied and purchased.

Each of these standards assess credits against many different identifiers of quality, which include (but are not limited to):

The recent United Nations Conference of Parties (UN COP29) climate summit has also delivered two promising outcomes for carbon markets:

Agreement on Article 6 from within the 2015 Paris Agreement, which oversees international carbon markets. Specifically, the two clauses below:

The UK Government also unveiled a set of six overarching principles for the Voluntary Carbon and Nature Markets to promote integrity.5

These actions at COP29 are a positive signal for carbon markets and an acknowledgement of the potential they have to contribute to address global emissions.

A voluntary carbon credit is a tradable certificate that represents one metric tonne of carbon dioxide that has either been reduced, removed or avoided from entering the atmosphere. These carbon projects include activities like afforestation, restoring peatlands and or deploying new technologies like Direct Air Capture.6

Bringing this to life, UK greenhouse gas emissions in 2023 are estimated at approximately 385 million tonnes of CO₂,7 and to capture one tonne of CO₂, you would have to grow approximately 50 trees for one year.8 The VCM is where these carbon credits are then issued, traded and retired between businesses.

Businesses can buy carbon credits to mitigate emissions that they cannot eliminate immediately by themselves, helping them realise their sustainability goals. In doing so, their money funds projects that actively reduce, avoid or remove harmful emissions and can also contribute to wider benefits.

To limit warming to 1.5°C, collective action is essential. Governments, businesses and individuals must work together to drive systemic change. No business can achieve net zero alone, and no business can afford to be left behind.

For a business to transition credibly, it needs a long-term plan in place to guide their journey to net zero, with clear near- and long-term targets. In the short term, we recognise the Climate Change Committee (CCC)’s guidance that businesses should focus on reducing their own emissions first.9 They can take various actions today, such as investing in energy-efficient measures, opting for more sustainable travel or using resources more efficiently in production – to name just three.

However, some emissions are harder to address; perhaps an alternative technology is not yet accessible (e.g. aviation or heavy freight), or emissions are generated from further down their supply chain, which they have less control over.

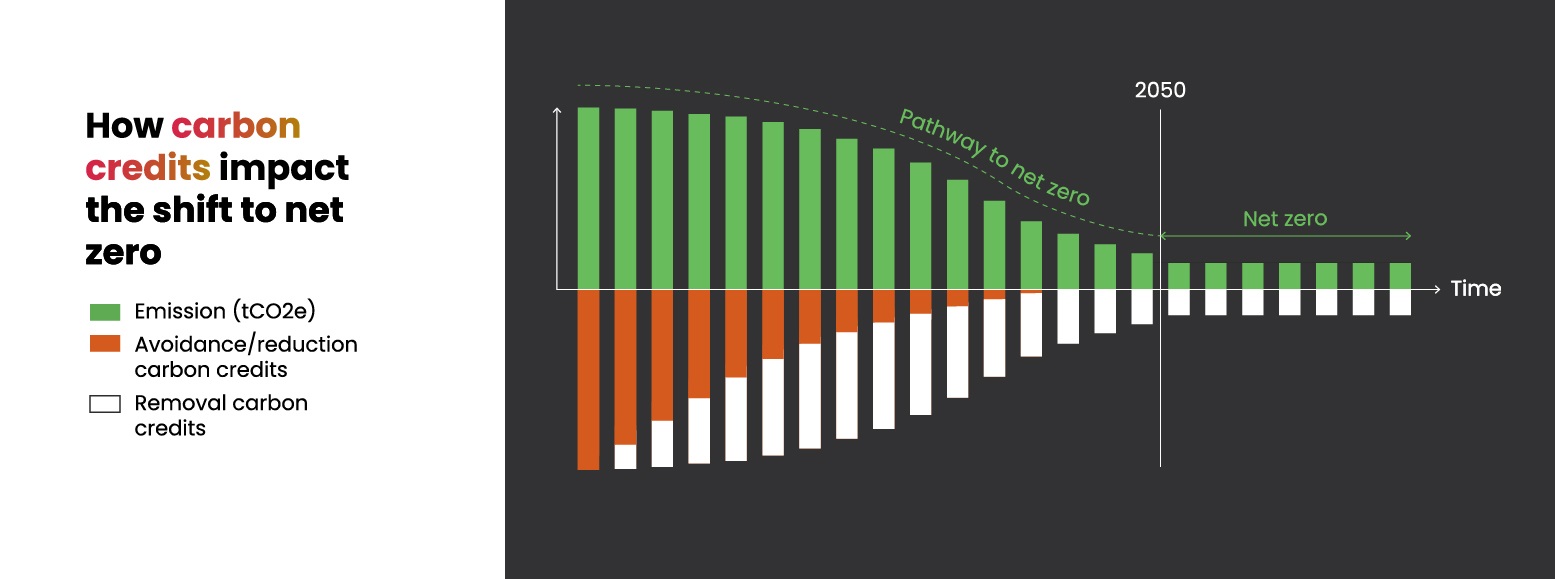

For these reasons and many more, businesses cannot transition overnight. In the meantime, they will continue to have residual emissions, which should be reducing year on year, while a company transitions towards net zero. These are the emissions that are difficult to avoid or fully eliminate due to technological, financial, or other limitations.

This is where carbon credits can help, by providing companies with the option to do something to mitigate their activity right now, alongside their continuing reduction efforts.

Businesses can mitigate these emissions through either buying credits through the VCM, where benefits are generated outside of their value chain (commonly known as offsets), or they can pay their suppliers to make sustainable changes, in what is called ‘insetting’. For example, a bread company might work with its wheat farmers to adopt more sustainable farming practices, like cover cropping or using lower nitrogen fertilisers. Businesses can also choose to adopt a blend of both options.10

In the short term, most carbon credits will come from projects that avoid or reduce emissions, which make up approximately 90% of the market today.11

However, as these projects become more common, and financially viable, they won’t be considered additional. For example, wind farms used to need carbon credits to be financially viable, but as the renewables market has scaled up, the cost of delivery has reduced. Today, many of these projects are no longer seen as additional.12 In the long term, businesses will need to focus on Carbon Dioxide Removals (CDRs), through planting trees or using Carbon Capture & Storage (CCS).

Analysis by the Intergovernmental Panel on Climate Change (IPCC) shows that carbon removal is key in achieving global climate targets by 2050, with estimates ranging from between 5 – 16 GtCO2e per year needed by 2050.13

Currently, global CDRs capture approximately 410,000 MtCO2e,14 equivalent to 0.000041 GtCO2e,15 so more is needed to ensure the 2050 scenarios are achievable. McKinsey cite estimates that require an additional 0.8 – 2.9 GtCO2e of CDR capacity by 2030, 3 – 10x times more than the volumes currently forecasted by that date.16

The VCM is a key enabler to support the scaling up of the CDR sector, providing financial incentives for business investment into these key technologies.

Project developers implement the activities that reduce, avoid or sequester greenhouse gas emissions, such as peatland protection or seagrass planting.

Independent guidance organisations set the standards for what constitutes a credible project and then work together with both:

Credit registries to certify the projects, create and track the associated carbon credits; and Independent auditors to validate and verify this.17

Intermediaries, such as brokers, banks, traders, platforms and exchanges may be involved in the financing, aggregating, exchange and retirement of carbon credits generated from projects.

Data and ratings agencies may also provide additional insights into the quality of different carbon credit projects.

We recognise that businesses are seeking to balance ambition and credibility as they navigate the journey of transforming to a low carbon future. Crafting a robust and credible transition plan is multifaceted, but putting a plan in place is critical for a business getting to net zero.

Whether and how a business intends to make use of carbon credits is an important component of this assessment, but it is by no means the only factor that is important to consider.

So, what should organisations consider when buying carbon credits? We’ve distilled this into three themes:

Businesses then face a choice in deciding whether to invest in mitigation action further down their supply chain (insets) or outside their supply chain through external businesses (commonly known as offsets) or a blend of the two. There are benefits and drawbacks of each approach; insets provide businesses with greater control, but more internal due diligence, whereas purchasing offsets through a recognised registry can minimise the governance but having less control invites other risks.

When choosing the types of credits to purchase, it’s important to prioritise high integrity credits linked to projects that deliver measurable and credible outcomes. Buying credits from projects that are verified to a recognised standard such as Verra or the Woodland Carbon Code, can help to mitigate concerns about credibility.

It’s also important to select credits that align with an organisation’s strategy and overall preference for wider environmental and social benefits – things like biodiversity or support for local communities. For example, businesses might want to prioritise credits that are aligned with their products or supply chain. Ratings agencies can help inform credit selection; they rank projects against key quality criteria and offer explanations of where a particular project may have strengths or weaknesses.

Before purchasing carbon credits, it is important for a business to have already developed a comprehensive emissions reduction strategy. This will help identify where they can make changes today to reduce their impact. It will also identify where they have unavoidable emissions for the medium term. And we would encourage businesses to mitigate the impact of these emissions whilst they are on the downward curve towards net zero.

High quality emission reduction and avoidance credits are commonly used for mitigating near-term emissions. However, any long-term mitigation strategies will need to consider high quality carbon removal credits, and these credits are typically more expensive.

By adhering to these themes, buyers can contribute to genuine climate action, fostering transparency and credibility in the carbon credit market. This approach not only supports meaningful climate action but also builds trust and promotes sustainable development.

As we navigate the complexities of our changing climate, high-quality voluntary carbon credits emerge as a practical and impactful tool for organisations to mitigate emissions as they act to reduce their own carbon footprint.

It's important to incorporate carbon credits as part of a broader, long-term climate strategy – for both ourselves and our clients. This involves developing a credible transition plan that adheres to industry best practice and considers where credits can play a helpful role alongside wider efforts to reduce emissions. As guidance on credible transition planning develops, it’s clear that high-integrity carbon credits can also be used deliver against multiple objectives for nature and societal benefits.

By adhering to best practice guidance, such as the recent publication by the Glasgow Financial Alliance for net zero on Nature in net zero transition plans18 and the Transition Plan Taskforce advisory paper The future for nature in transition planning19, organisations can ensure their efforts are both effective and sustainable.

With careful planning and due diligence, the VCM offers a promising avenue for climate mitigation investments, which have the potential to drive transformative change.

Senior Manager, Sustainability & Responsible Business at Lloyds Banking Group

Rachel Finesilver works in the Environmental Sustainability team within Business & Commercial Banking. This team supports the Group's business clients (turnover of £100m and below) with their transition to Net Zero. To date, Rachel has covered many different sectors from Housing to Transport and more recently Food & Farming, alongside Voluntary Carbon and Nature Markets.

Prior to joining the sustainability team in 2020, Rachel spent eight years in a variety of roles across the broader Group – within Mid Corporates performance management, Trade & Working Capital and before that Collections & Recoveries in Consumer Lending.

As the UK’s largest financial services provider, we have an important role to play in creating a more sustainable and inclusive future for people and businesses, by shaping finance as a force for good.

6 March 2025 | Andrew Walton

The latest carbon budget, released by the Climate Change Committee (CCC) on 26 February, highlights electrification and private sector financing as crucial for reducing emissions.

Supporting the UK transition to net zero and protecting nature building resilience and creating a more sustainable future for Lloyds Banking Group, customers and communities.

Popular topics you might be interested in

Sustainability Diversity Supporting business Housing Pensions Investment