Our purpose and strategy

Our purpose is Helping Britain Prosper.

Back in the early eighties, few could have predicted just how big of an impact the internet would eventually have on our lives. Then a little-known technology used mostly by government officials, even Robert Metcalf, one of its leading engineers, expected the web to “go spectacularly supernova and in 1996 catastrophically implode.”1

This prediction, of course, did not play out. And today we face another, rapidly approaching and extremely powerful technology with the ability to drastically change our lives – infinitely more powerful than the web, it has left some optimistic and others cautious. I’m talking about quantum computing.

A quantum computer is an incredibly complex machine that offers seemingly endless possibilities. On the one hand, it has the potential to change the way we live and work for the better. But the power of these machines could also be used to undermine one of the key security structures that systems like the internet rely on.

Here at Lloyds Banking Group, our aim is to cut through the noise and separate hype from reality – to look at the evidence and evaluate how new technologies can be used to enhance the lives of our customers and colleagues. With that in mind, here’s a run-down of quantum computing, and how it might impact financial services.

The subject of quantum mechanics has featured in both sci-fi novels and respected academic papers for the best part of one hundred years. It wasn’t until the 1980s and the advancement of the internet, though, that scientists started to look seriously at computers that could use quantum mechanics to process data and execute code.

The idea was that these quantum computers might one day enable us to process large, complex, multi-variable problems previously considered impossible within a human lifetime, and allow us to find solutions to intractable problems.

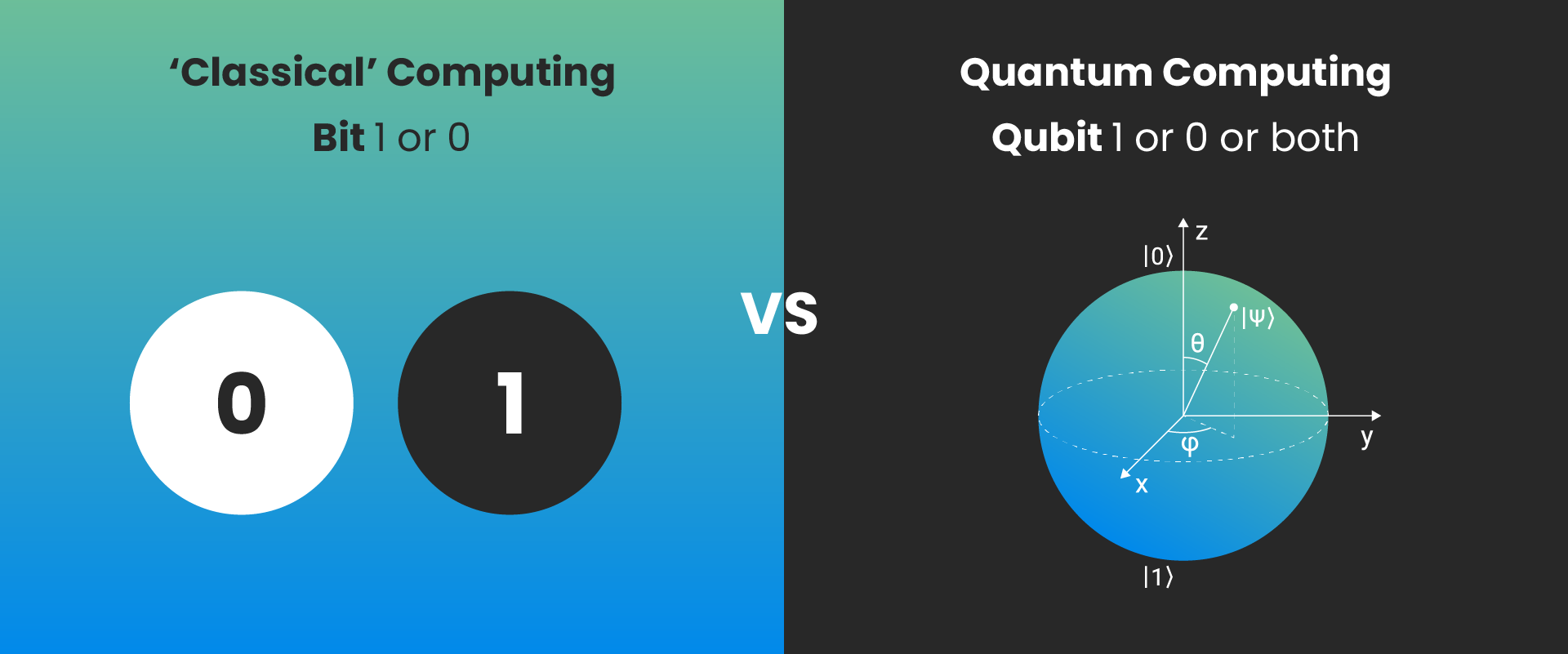

The primary difference between quantum computers and the classical computers we use today, is that the latter process data in units of zeros and ones using ‘bits.’ Quantum computers, on the other hand, process data using ‘qubits’ which can be zero or one, and everything in between, all at the same time.

If that sounds complicated, think of it like this: back in 2015 you may remember a certain dress circulating around the internet. To some the dress was blue but to others it was green. Now, to the observer both of these answers were correct at the same time.

It was only when the owner revealed that the dress was actually blue and black that the observer got a definitive answer. It’s the same principle for quantum computing; a qubit can represent multiple options at the same time on the journey to a definitive answer. This ability, known as superposition, is the key that enables quantum computers to operate differently to classical computers.

As impressive as that sounds a single qubit only represents a single variable. To solve multi-variable problems, you need many qubits to represent many variables. Linking qubits together is called entanglement, and means that a change in one qubit is automatically reflected in the other connected qubits. This enables what’s known as exponential scale of processing. For example, Google's new quantum chip Willow, can perform complex calculations in minutes that would take the world's largest supercomputer 10 septillion years, potentially revolutionizing fields like AI, medicine, and energy.2

But with these entangled qubits all connected, you still need to find an answer to the problem you are trying to solve and this is where inference comes into play. Inference amplifies or cancels out potential combinations or probabilities to help reveal the desired answer.

It’s important to note that quantum computers are not going to replace all classical computers. There are tasks that existing computers will always be better at, and so deploying a quantum computer wouldn’t be the right decision but for certain tasks, they may well be the best tool in the toolbox.

We’re using the power of tech and data to offer our customers hyper-personalised services and seamless experiences on their device and channel of choice.

Quantum computing has the potential to solve problems that today we think of as unsolvable. The development of new pharmaceuticals and materials, efficiency of complex systems such as supply chains and energy distribution, and machine learning models could all see transformational impacts as a result of quantum computing. But there are downsides to using the technology too.

For example, qubits are extremely sensitive to external factors such as temperature, sound and physical movements which would cause them to decay, and errors to occur within the computations.

This is why today’s quantum computers are incredibly complex pieces of engineering. Most operate at very low temperatures and in vacuum environments to minimise these external factors and maximise performance of the machines.

But even with all this complex engineering, today’s quantum computers are not yet able to outperform classical computers. Major technology companies and startups are experimenting with different approaches to create and control qubits to reduce the risk of errors, and increase the scale of calculations that can be performed.

The complexity isn’t just limited to the actual machines themselves. How software engineers interact with and develop for quantum computing will be very different to their experience of software development today. Knowledge of information technology will need to be coupled with mathematics and physics to successfully leverage quantum computers, and so the journey to adoption will include new skills and training efforts to upskill our colleagues.

From complex system modelling to working alongside classical algorithms to improve accuracy, there are a myriad of ways that quantum could be harnessed to improve financial services. A key strength of the technology however, lies in it's ability to assess large, multi-variable data sets.

Thanks to the unique properties of qubits, such as superposition which allows them to represent multiple states at once, quantum computers can process and compare vast, multi-dimensional datasets simultaneously. This enables them to uncover subtle relationships within data sets far faster and more efficiently, opening the door to transformative applications across banking.

At Lloyds Banking Group, we’re exploring how quantum computing can be harnessed to strengthen our defences against fraud. In partnership with IBM, we’re running an experiment to understand how quantum algorithms could detect fraudulent activity more quickly and accurately than ever before. By analysing complex patterns in transaction data, quantum computing has the potential to spot subtle anomalies that might be missed by classical systems.

This experiment is an important step in our ongoing commitment to safeguarding our customers, and we look forward to sharing more as our work with IBM progresses in the coming months.

"Today, financial services embrace digital analytics to better understand customer needs and create better outcomes. And looking ahead, the coming age of quantum computing will bring about an even greater change."

Another key capability of a quantum computer is factorisation, or the process of finding factors of large numbers.

But what does factorisation have to do with breaking the internet? Well, the public key encryption technologies used today to store and transit data across the web, like RSA and ECC, are based on asymmetric encryption approaches which use incredibly difficult mathematical problems to prevent someone other than the intended recipient from decrypting the data.

The world has relied on the fact that no computer is powerful enough to solve these hard mathematical problems and so our data flows around the internet safely. However, in 1994 Peter Shor developed an algorithm that, with a powerful enough quantum computer, could undermine the security of all this data.

And this threat doesn’t just become an issue at the point when a powerful enough quantum computer is built. There is also the risk that valuable data will be stolen today, stored by bad actors waiting for the right quantum computer to be built at which point they can reveal the sensitive data.

Whilst this might seem like a strange technique, particularly as the payoff is potentially many years away, there is sensitive data like medical or financial records that would still be very valuable, even in five to ten years. This is commonly referred to as the ‘Harvest Now, Decrypt Later’ risk, and it’s pushing organisations to move to quantum safe encryption sooner, rather than later.

Earlier this year, the National Institute of Standards & Technology (NIST) ratified several post quantum encryption standards and recommended organisations like Lloyds Banking Group begin transitioning to the new standards, as soon as possible.

The Group has started this journey with our strategic security partners collaborating across government, industry, academia, investors and startups. Through 2025 we plan on initiating a crypto modernisation programme to fully understand our current needs and capabilities, develop a target technology, operating, and governance model, and define delivery method for delivery of target state.

Over the last decade, progress in quantum computing has accelerated rapidly. Now, experts predict that these powerful machines are between five and ten years away from hitting the mainstream. But given the opportunities quantum computers could bring, it’s imperative that organisations across the board continue to build their understanding of quantum computing, as well as be prepared to experiment with quantum computing algorithms.

The experiment that we’re currently running with IBM to explore how quantum computing could further enhance our fraud prevention capabilities is part of this commitment. We’ll be looking at the results of this collaboration early next year and look forward to sharing more about how these innovations could help protect our customers in the future.

As one of Britain’s largest financial service providers, we want to harness the power of emerging technologies such as quantum computing in a way that serves both our customers, and our colleagues - ensuring we are prepared for the future and in the best position to help Britain prosper.

Enterprise Architect at Lloyds Banking Group

Jamie started out with the Group as a Solutions Architect in 2005, and is now Enterprise Architect for the Group’s Emerging Talent and Innovations Team.

27 Aug 2025 | Duncan Kirkpatrick

Lloyds Banking Group is transforming the insurance experience through digital tools like five-minute claims processing and self-service policy management, while maintaining human support for complex cases.

29 August 2025 | Rohit Dhawan

Lloyds Banking Group’s responsible AI framework ensures rigorous testing, human oversight, and scenario planning to prevent harm, with real-world safeguards like escalation protocols for virtual assistants and fraud detection systems.

18 August 2025 | Rob Hale and Peter Left

By embracing digital assets, smart contracts, and DLT, we’re not just improving existing processes – we’re reimagining what’s possible.

Popular topics you might be interested in