Why do women retire with less money than men?

Women face a 32% gender pension gap driven by career breaks, childcare responsibilities and lower investment confidence, but with practical steps and policy support this gap can be closed.

30% of people are now expected to rent in retirement – but in some areas, rents will cost 130% of people's retirement income.

As the disparity between house prices and wages continues to grow, home ownership is becoming an unattainable prospect for many people. This is having a knock-on impact on the provisions that people need when it comes to saving for their retirement, with 30% of people now expected to rent and face the ongoing cost of housing in old age.

The latest Scottish Widows Retirement Report shows that in some areas of the UK rents can be equal to – or in excess of – average pensioners expected retirement income. Rent is therefore likely to be a significant burden for many in retirement. But how can savers prepare for these costs, and what can the government and pensions industry do to best support them?

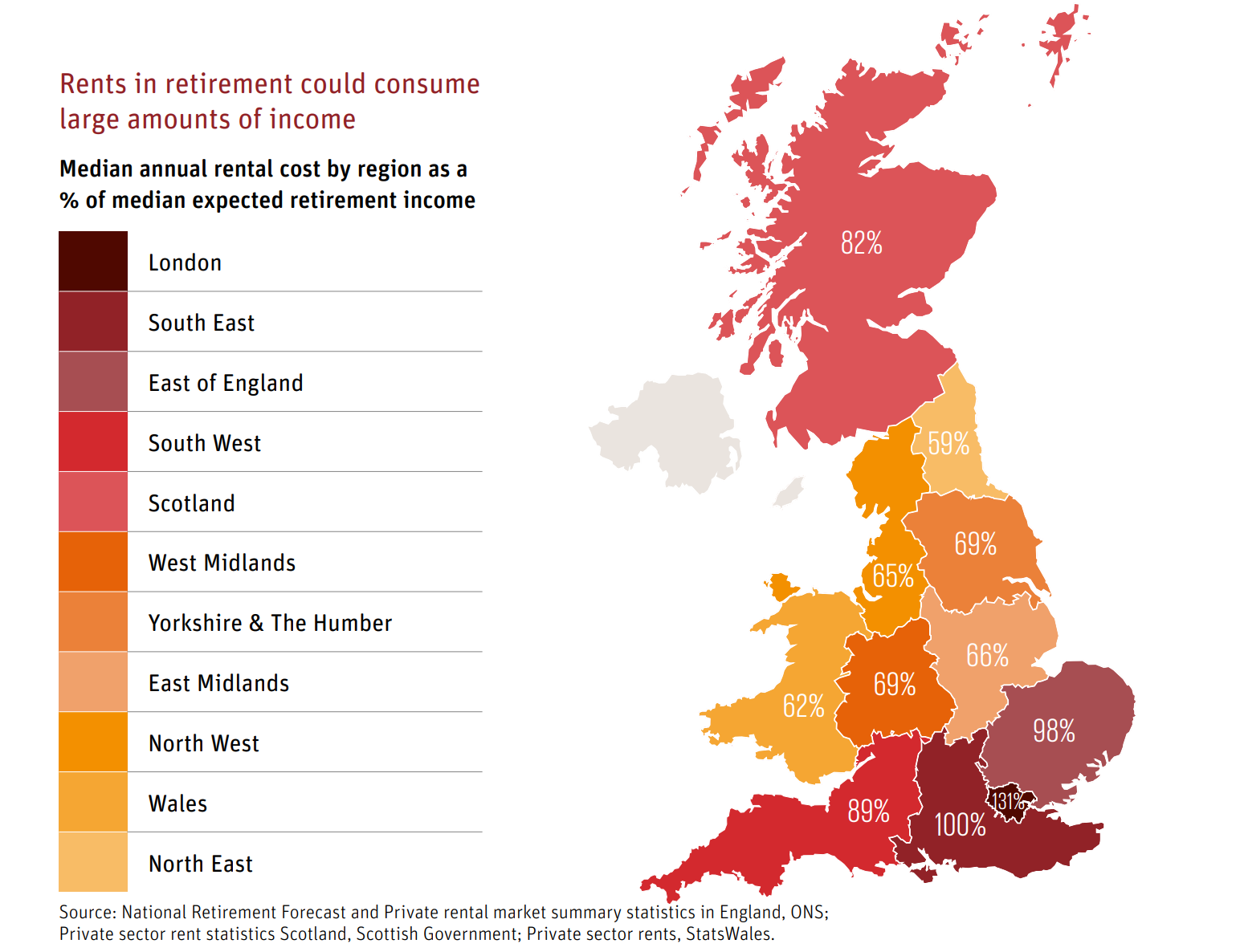

The cost of renting varies dramatically depending on location. People renting in London will face rents that are 131% of the average expected retirement income. Staggeringly, this is three times the cost of rents in the North East. Renters living more widely in the South also face elevated costs compared to those in other regions too, with rents equalling 100% of the median expected retirement income in the area.

All this suggests that, for retired people renting in and around London and the South, housing benefit and other retirement benefits will play a vital role to ensure that they have even the most basic standard of living.

Scottish Widows Retirement Report 2023

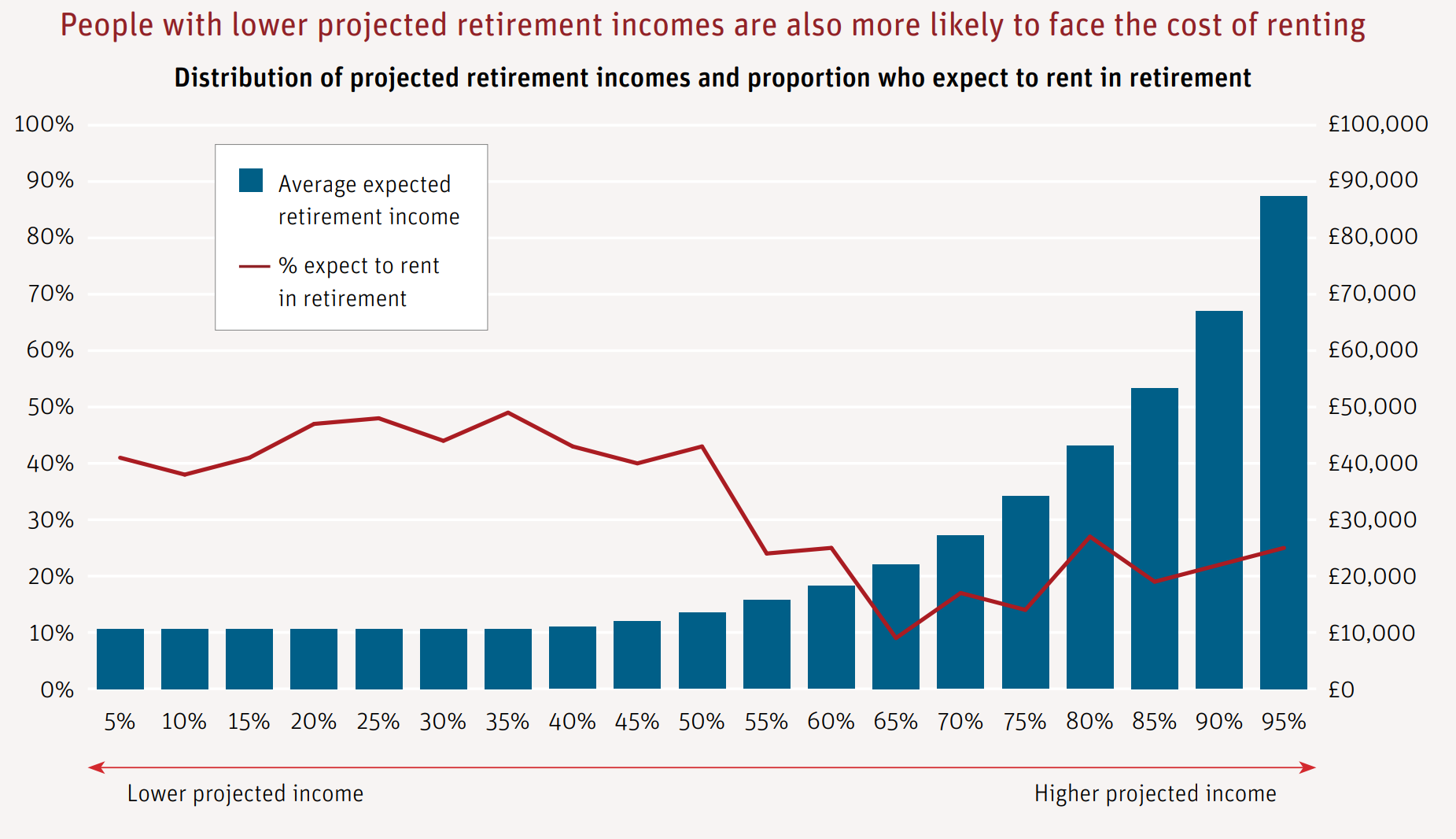

As well as the geographical disparity, the burden of renting is also more likely to fall on those with lower incomes in retirement, with people with the lowest projected retirement incomes being most likely to expect to rent (43%). This drops to around only 20% of those on higher projected retirement incomes.

Scottish Widows Retirement Report 2023

However, even in the cheapest areas the cost of renting is still significant, with rents in the North East absorbing over half (59%) of retirees projected incomes. Halifax advises that, as a general rule of thumb, roughly 30% of an income is about the right benchmark to be paying on rent so that a person has enough left over to afford the rest of their monthly outgoings. With even the cheapest projected rent taking up nearly double that, it could make it especially difficult for retired renters to reach even a minimum standard of retirement.

To manage, many lower income renters are likely to hope to rely on housing benefit, or they may need to downsize to smaller and cheaper accommodation to help reduce rental costs.

With such a big portion of their income going on rent, retirees may also have to make compromises and cutbacks in other areas, such as food shopping and holidays. However, the research for the Scottish Widows Retirement Report has shown that 35% of savers aren’t on track for even a minimum lifestyle in retirement.

Given the vulnerability of these older renters, more also needs to be done to provide high-quality social housing to stop retirees facing homelessness. In 2018 (the latest figures available), there were 2,500 people aged over 60 who were officially homeless – double the number than in 2009. And in 2017 the Local Government Association warned that the issue was only going to become more prevalent, with the number of existing elderly homeless set to double by 2025.

Moreover, social housing that’s currently planned or in development needs to be built in a way that enables homes to be easily adapted as residents needs change, with research from the Centre for Aging Better finding that 80% of older people want to stay in their home as they age. This means housing that is accessible and that can be easily adapted as mobility needs change.

There’s a significant shortage of social housing in the UK, with a shortfall of around 100,000 new social homes every year and over a million people currently on the waiting list in England alone. Lloyds Banking Group is the biggest supporter of social housing in the UK. Since 2018, we’ve supported around £15 billion of funding to the sector, helping build over 35,000 homes. We’ve recently partnered with homeless charity Crisis, and together we’re calling for one million more homes for social rent across Britain by 2033.

"There are currently over a million people on the waiting list for social housing in England alone."

Roughly two thirds of people expect to own their home in retirement. Provided that they are largely mortgage free by the time they retire, these people will not only save substantial amounts on rent, but they’ll also have the option to build up equity which they then can potentially access through equity release.

Typically a retired homeowner might access around a third of their equity, and the average value that is accessible will vary across the country, mirroring house prices. For most regions of the UK, typical equity release could provide an additional £60,000 to fund retirement. In the South East this doubles to over £120,000, and in London it’s over £170,000.

Access to housing is crucial in order to enhance retirement outcomes. Improving housing affordability is central to this, and means we need to ramp up house building. This would result in renting being more affordable, and fewer would need to rent in retirement if they could get on the housing ladder.

Scottish Widows’ Retirement Report demonstrates more clearly than ever that while many are making good preparations for retirement, a substantial minority are being left behind. While addressing the high cost of living is rightly the government’s priority for the time being, as inflation goes down and conditions begin to stabilise, more needs to be done to address the long-term reforms and enhancements to automatic enrolment if savers are to enjoy a comfortable retirement income.

Automatic enrolment has undoubtedly been a game changer, with many savers in their 30s now likely to reach a comfortable retirement lifestyle, with auto enrolment playing no small part in establishing these strong saving behaviours.

The self-employed have also not benefited from automatic enrolment and as a result are much less likely to be saving into a pension. The forecast shows that while the self-employed do proportionately save more outside of a pension, this is not nearly enough to close the gap.

The report also shows the important role that a variety of assets have in retirement. Workplace Pensions and Personal Pensions are central, but so too is the state pension, wider savings that individuals accumulate or inherit and the equity that many build up in their homes. People need to be getting guidance, advice and support that brings all of these elements together to help them plan effectively for their retirement.

Our findings also highlight the disparities between those who are likely to rent in retirement and those who will own a home. Those on lower incomes are disincentivised from saving for retirement and are encouraged to rely on housing benefit, while those on middle incomes save too little to cover their rent and end up facing a much poorer retirement than they expect.

27 Jun 2023 | Pete Glancy

What impact will the changes to the pensions lifetime and annual pensions allowances have on the UK economy – and is it really a ‘big tax giveaway’?

This is a complex challenge that we need to explore to give people the opportunity and incentives to prepare effectively for their retirement. We need a multi-pronged approach to address the issues of renting in retirement which consists of more holistic conversations around retirement planning, taking into account pensions wealth, other savings and the role of housing.

In terms of the changes needed to automatic enrolment, we encourage the government to announce a timetable for reforms that will reduce the age requirement to 18, and remove the lower earnings limit. We recommend this is set for the mid 2020s to allow employers time to prepare. This will be most valuable to the young and lower paid.

The automatic enrolment threshold also needs to be lowered from £10,000 so that lower earners can also benefit. Those earning below £10,000 should be able to opt-out of employee contributions while still receiving employer contributions.

We’re also calling on the government to develop a plan to further enhance automatic enrolment once the cost of living crisis has been weathered. The next milestone should be to gradually raise contributions to 12%, but with clear and consistent messaging that those who can afford to do so save at least 15%. This is necessary to drive the kinds of living standards that people expect in retirement, and should help provide more of a buffer to those who will also have to take on rental costs.

Finally, improving housing availability is a vital factor in securing better retirement outcomes. The government needs to build more homes and free up housing provision to allow more people to get onto the property ladder and bring down rental costs, as well as increase the supply of social housing stock for lower income households. Giving the elderly population a route to secure and affordable housing is one of the most crucial ways to ensure that people can enjoy a safe and comfortable retirement.

Pete is the Head of Policy, Pensions and Investments at Scottish Widows, part of Lloyds Banking Group's Insurance and Wealth division.

Pete has worked at Lloyds Banking Group for 31 years, holding a wide range of senior positions, including Head of Individual Pension Propositions and Head of Workplace Pension Propositions before taking on the pensions policy brief 6 years ago.

Pete is on the Pensions Panel at the CBI, and the Strategy Council at TISA in addition to numerous industry and trade body working groups

Women face a 32% gender pension gap driven by career breaks, childcare responsibilities and lower investment confidence, but with practical steps and policy support this gap can be closed.

Lloyds Banking Group is transforming the insurance experience through digital tools like five-minute claims processing and self-service policy management, while maintaining human support for complex cases.

As we move through the second half of 2025, the UK remortgage market is undergoing a significant transformation. The landscape today is shaped by the maturing of fixed-rate mortgage deals secured in the pandemic-era ‘race for space’.

Popular topics you might be interested in