Why do women retire with less money than men?

Women face a 32% gender pension gap driven by career breaks, childcare responsibilities and lower investment confidence, but with practical steps and policy support this gap can be closed.

Research by Scottish Widows shows that self-employed and part-time workers are more likely to fall short of the minimum standard of living in retirement.

This year Scottish Widows published the 20th Annual Retirement Report. It’s a huge milestone, with each report following the changes that have taken place within the pensions industry over the last two decades.

The latest publication explores which societal groups are the least likely to achieve good outcomes in retirement, looking at why they’re facing these barriers to saving, and how these issues can be addressed – both at an industry and a policy level - to help bring about better retirement outcomes for more people.

The report compared research findings across different employment types. It found that workers who are self-employed, part-time workers and those whose income comes from multiple employments tend to be the least provisioned for in retirement.

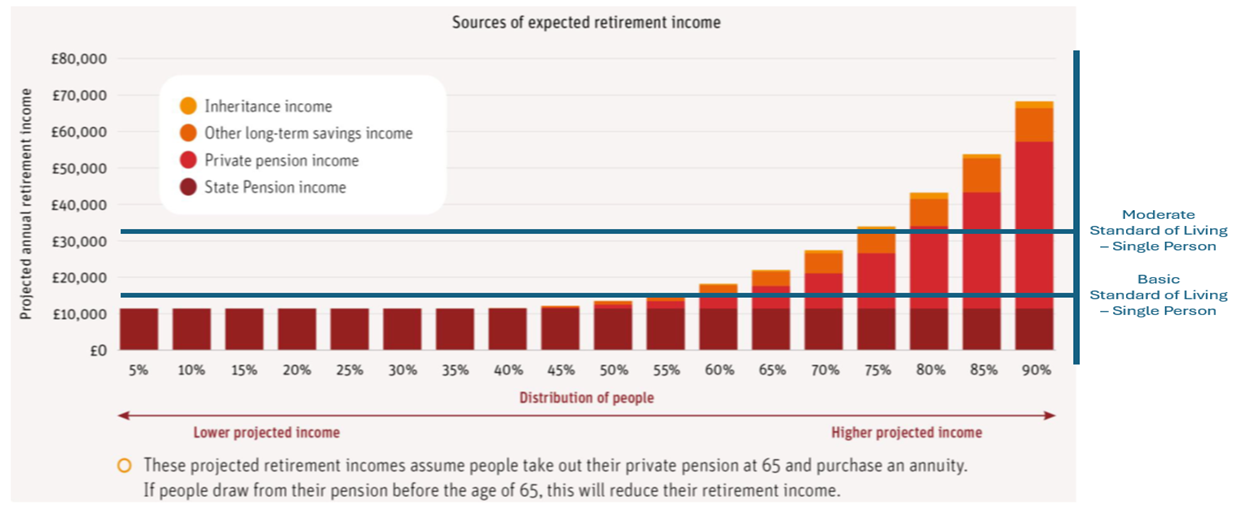

The least affluent 50% in our population will struggle to have enough income between their State Pension and any private pension income to even cover the basics. Only the top 25% of the population will be able to enjoy a standard of living which is described by the Pensions and Lifetime Savings Association as ‘moderate’.

The self-employed, part-time workers and those with multiple employments are over represented in the first five deciles in the diagram above and are more likely to experience poorer retirement outcomes.

The introduction of automatic enrolment has been the biggest positive change in pensions. Since its introduction in 2012, more than 10 million extra savers have been brought into workplace pension saving for the first time. Opt-out rates have been lower than anyone predicted, and even during the pandemic when some people faced significant financial hardship, there was no discernible increase in opt-outs.

But while the policy helps a vast number of workers achieve a higher income in retirement, many will still be falling short of the savings they need to be making now if they are going to have a comfortable lifestyle when they get older.

To address this, we need contributions to rise from the current 8% to 12 % (with strong guidance that those who can afford to do so save 15%) of all earnings, for the full power of automatic enrolment to be realised.

Aside from automatic enrolment, the UK needs to continue progress in adapting its pension systems to the modern world. People change jobs more than they did in the past and there is more fluid movement between people choosing to work full time or part time, and employed or self-employed. The retirement system needs to adapt to fit the complexities of modern life. We are also living much longer and its not possible to save enough money during a working life of just 40 years to pay for a retirement which could last 30 years.

There are over four million self-employed workers in the UK who are currently excluded from auto enrolment. 41% of part-time employees aren’t on track for even a minimum lifestyle in retirement (compared to 25% of full-time employees). This is driven by part-time workers earning less, but also because many of them don’t qualify for automatic enrolment as they fall below the threshold of earning £10k per year. Multi-jobbers could have total earnings of £24k across three jobs each paying £8k, with none of those employments triggering auto enrolment.

There’s also currently no equivalency of auto enrolment for self-employed workers, and as a result, 38% of self-employed workers aren’t on track for even a minimum lifestyle in retirement. This needs to be urgently addressed so that retirement provision becomes par for the course, no matter what type of work someone is in.

To help improve retirement outcomes for those working part-time, we believe that the £10k earnings threshold at which workers are auto enrolled should be abolished. However, workers on those very low levels of earnings should be able to opt out of the employee contribution, whilst still benefiting from an employer contribution towards their retirement.

This is on the premise that no-one should be too poor to receive a contribution from their employer towards their retirement.

Women, the disabled, some ethnic groups and many within the LGBTQ+ community are also over-represented in these forms of employment, and these reforms would go a long way to addressing some of the polarisation that we see in projected outcomes across different cohorts of the population.

The latest Women and Retirement report from Scottish Widows shows that women working today are still more likely to experience worse retirement outcomes than men.

The auto enrolment ecosystem designed for employees would not work for the self-employed, because it runs on payroll systems which are not used by the self-employed and the incentive comes from a ‘someone else’ putting at least 3% of your salary into your pension pot, where that ‘someone else’ is an employer.

An equivalent of auto enrolment needs to be developed using an alternative technology ecosystem to payroll, and with an incentive structure which is appropriate to the self-employed.

These two reforms would go a long way to improving the retirement prospects of the nation. These sit alongside of a wider suite of reforms which we have set out in our Retirement Report and further reforms which we will shortly set out in our Women and Retirement Report.

Pete is the Head of Policy, Pensions and Investments at Scottish Widows, part of Lloyds Banking Group's Insurance and Wealth division.

Pete has worked at Lloyds Banking Group for 31 years, holding a wide range of senior positions, including Head of Individual Pension Propositions and Head of Workplace Pension Propositions before taking on the pensions policy brief 6 years ago.

Pete is on the Pensions Panel at the CBI, and the Strategy Council at TISA in addition to numerous industry and trade body working groups

Women face a 32% gender pension gap driven by career breaks, childcare responsibilities and lower investment confidence, but with practical steps and policy support this gap can be closed.

We all know that the financial world can be unpredictable, and this is especially true against the backdrop of today’s ever-changing political landscape. Given this, it’s therefore only natural then that people are looking for ways to secure a stable income for their golden years. Annuities could be the answer.

The UK’s pensions landscape has dramatically evolved over the past 20 years. Today, factors such as changes in policy, the rise of new technologies and a changing economy, have all significantly impacted the way that people are preparing for retirement.