Our purpose and strategy

Our purpose is Helping Britain Prosper.

Following the launch of the Mansion House Compact, we explore the potential for the government and the pensions industry to work together to create a virtuous circle of improved performance across the UK economy and better outcomes for pension savers.

At the beginning of July, the Chancellor made a series of announcements setting out plans to boost outcomes for pension savers, as well as to facilitate greater investment in UK companies from pension funds.

One of these announcements was the Mansion House Compact - an industry commitment made by many of the UK’s largest pension providers (including our insurance and pensions business Scottish Widows), with the objective of allocating 5% of assets in default funds (which is where your pension savings are invested if you don’t choose your own investments) to unlisted equities (shares of companies which are not traded on the open market) by 2030. Through this commitment the Chancellor hopes to make the UK a more attractive prospect to high-growth companies, with the aim of ultimately helping to boost our economic growth and also delivering better returns for pension savers.

"We’ve seen defined contribution

pensions move away from investing in

the UK to seeking out the best risk

adjusted investment returns for

customers internationally."

Historically, the UK pension system centred around defined benefit (or final salary) pension schemes, where employers each funded a large pot of money that was used to pay incomes to their former employees when they retired. The money in those pots was invested for the long term, with much of it put into UK assets as this was seen as a useful hedge against domestic inflation.

However, since the 1980s there’s been a gradual move away from defined benefit pensions to defined contribution (DC) pensions, with the vast majority of private sector employers now operating pensions on this basis. In DC pensions, contributions from both employer and employee go into pots which belong to the employee. These are then invested on their behalf, either by trustees or by a pension provider such as an insurer, but DC pensions are less likely to invest in assets which are illiquid.

This is for a number of reasons:

In theory, yes!

If, by working with government, the pensions industry can contribute to the creation of a higher volume jobs - more of which will be highly paid - as well as more successful companies here in the UK, then pension pots more generally will become larger. This is because people would be employed for a greater proportion of their working lives; they would have higher salaries on which their pension contributions are determined; and they would benefit from more generous levels of employer pension contributions if their employer was more successful.

However, defined contribution pension pots don’t belong to the government, or to employers, or to pension scheme operators. Each pot belongs to an individual, and each pot is required to be managed in a way which optimises the outcome for that individual.

To create a win-win, government and industry need to work together to remove structural barriers which prevent defined contribution pensions investing in illiquid assets. They also need to present UK based investment opportunities in a way which is sufficiently attractive to the owners of pension pots, such that the investment return is favourable to that which could reasonably be expected from investing elsewhere in the world.

In addition to the compact between industry and government which targets 5% of assets in default funds being invested in unlisted equities by 2030, the Chancellor has asked the British Business Bank to consider how UK opportunities could be originated. He’s also proposed that a new ‘venue’ be created which would reduce the cost of trading in unlisted equities.

Trading costs can be important. An excessive focus on price at the expense of investment returns could leave pension savers with smaller pots than need be the case. Nevertheless employers, trustees and their professional advisers remain largely fixated on price, and whilst we support the work of government to refocus minds on value and scheme member outcomes, it will take some time. In the meantime, a ‘venue’ which reduces the cost of trading unlisted equities could be a valuable ingredient in satisfying the 2030 compact.

"A study done by the British Business

Bank indicated that unlisted assets

could yield 19% returns per year,

compared with the 11% returns of listed ones."

Unlisted equities are associated with higher returns, but that also means higher risk. Pension funds tend to like portfolios of assets which sit somewhere between ‘cautious’ and ‘balanced’. If the British Business Bank was able to originate portfolios of assets across areas such as infrastructure, social housing, and innovative capital for businesses in a way where the collective profile of the opportunities was consistent with a ‘balanced’ investment profile, then the opportunities would be more conducive with Defined Contribution pension scheme default funds.

If these opportunities can be presented in a way which offers a better risk adjusted return to pension scheme members than alternatives available elsewhere in the world, then that too would turbo-charge uptake of UK based investment opportunities by defined contribution pension schemes. This could require an intervention from HM Treasury which positively moves the investment case in favour of the UK pension scheme member.

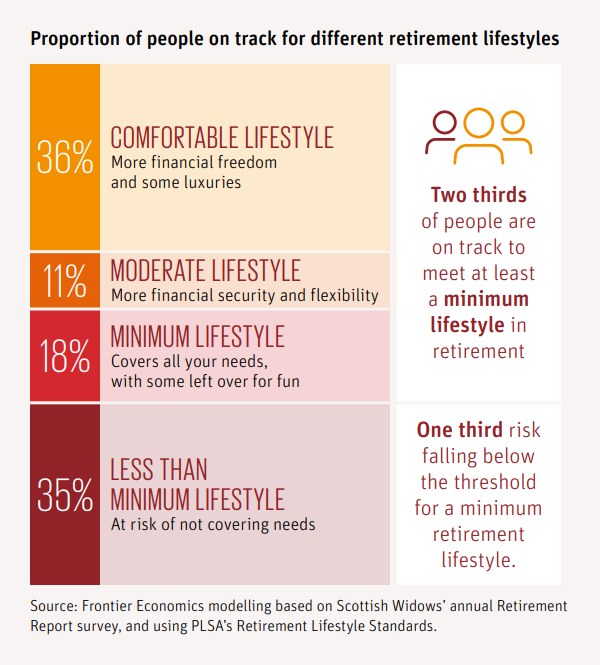

Scottish Widows recently published its new National Retirement Forecast, which showed that only 36% of the country are on course for a comfortable retirement, and 35% are not even on course for even a basic quality of life in retirement as defined by the Pensions and Lifetime Savings Association.

At present auto enrolment requires that a minimum of 8% of salary be put into a pension schemes for workers (3% from employers and 5% from employees). That isn’t enough, but increasing the statutory level of contribution from either employers or employees will be very difficult in the foreseeable given the current economic backdrop.

If, however, a way could be found of packaging UK based investment opportunities to show an investment upside to UK pension savers, not only would pensions capital flow towards these types of investment opportunity, but government would be able to demonstrate an alternative means of closing the retirement savings gap. At Scottish Widows we would be able to model any such impact in our next refresh of the National Retirement Forecast.

A study done by the British Business Bank indicated that unlisted assets could yield 19% returns per year, compared with the 11% returns of listed ones. The compounding effect of that extra 8% every year over someone's saving in a pension for 20 or 30 years is massive. As a result, this could be a serious ‘win’ when it comes to the potential investment returns on the pot someone has accrued over years of working.

However, unlisted assets are still higher risk, so we're not suggesting that we put all of our customers’ money into them. We’re simply proposing to give customers the opportunity to allocate 5% of their money from the 11% potential returns those with the potential for 19%.

The study was undertaken using data from the United States, who had the most comprehensive data set. Some parts of the US economy are benefiting from significant government incentives, making these sorts of return or higher. This suggests that unlisted equities have the potential to be an attractive area for defined contribution pension schemes to invest. The challenge for the UK will be to package, price and present opportunities which are comparably attractive.

Overall, the Mansion House Compact could create some exciting opportunities for growth in the economy, as well as in people’s pension pots. We need to make sure that there’s the right balance of risk versus reward, but with the right mindset, industry and government could find a material win-win for both pension savers and our economy.

Pete is the Head of Policy, Pensions and Investments at Scottish Widows, part of Lloyds Banking Group's Insurance and Wealth division.

Pete has worked at Lloyds Banking Group for 31 years, holding a wide range of senior positions, including Head of Individual Pension Propositions and Head of Workplace Pension Propositions before taking on the pensions policy brief 6 years ago.

Pete is on the Pensions Panel at the CBI, and the Strategy Council at TISA in addition to numerous industry and trade body working groups

Pete Glancy | 04 July 2023

30% of people are now expected to rent in retirement – but in some areas, rents will cost 130% of people's retirement income.

Pete Glancy | 27 June 2023

Pensions expert Pete Glancy explores what the long-term impact of changes to the pensions lifetime and annual pensions allowances will have the future of the UK’s economy – and why it’s far from being a ‘big tax giveaway’.

Robert Cochran | 23 March 2023

"Everyone’s a winner if we all work together to plug the financial knowledge gap."

Popular topics you might be interested in

Sustainability Diversity Supporting business Housing Pensions Investment