Our purpose and strategy

Our purpose is Helping Britain Prosper.

See how we've been Helping Britain Prosper: annual report and accounts 2019

£3.0bn (33%)

Statutory profit after tax was lower, largely due to the additional PPI charge. Tax expense of £1.4 billion.

3.37p (+5%)

Progressive and sustainable ordinary dividend per share, including interim and final dividends.

27%

Total shareholder return increased, reflecting the increased ordinary dividend and higher share price.

7.8% (3.9)pp

Lower return on tangible equity given lower statutory profit.

48.5% (0.8)pp

Cost : income ratio continues to improve.

13.8% (0.1)pp

Common equity tier 1 ratio remains strong.

16.4m +4%

Digitally active customers continued to increase.

74% +1pp

Employee engagement index improved.

"We have made significant strategic progress and our performance continues to demonstrate the competitive advantage of our business model."

António Horta-Osório, Group Chief Executive

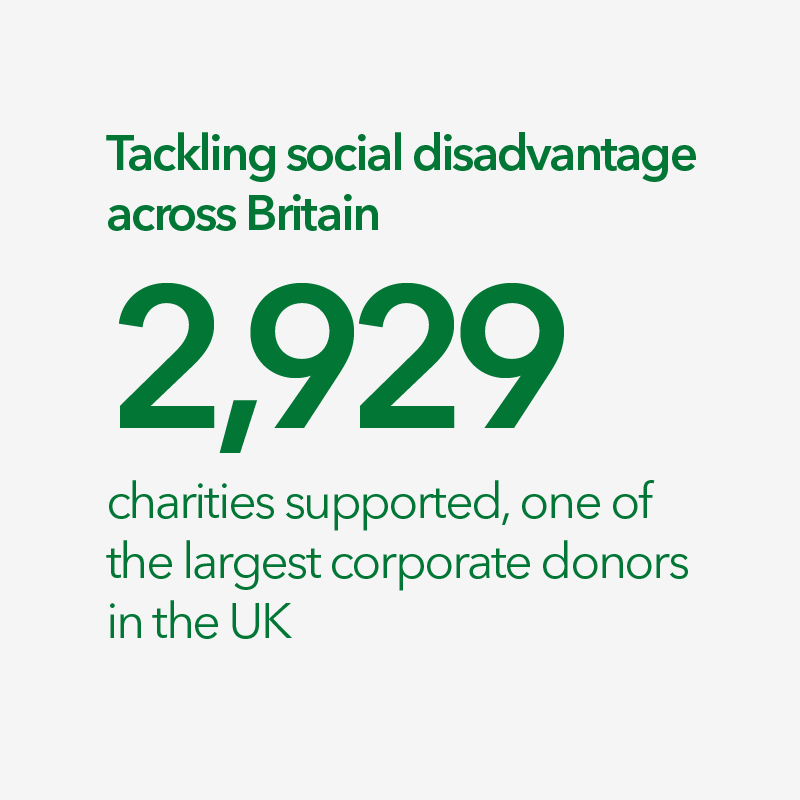

£13.8 billion lent to people buying their first home.

>100,000 small businesses supported across the UK.

>350,000 people helped to save for their future.

The Group's ambitious three-year strategic plan was launched in February 2018, and we are on track to achieve our targeted strategic outcomes.

Our approach to environmental, social and governance topics

Responsible business downloads

Register to receive all shareholder communications and documents in digital format.

We ask shareholders to access our documents online wherever possible, but if you need a printed copy of the annual report (free of charge) please contact the Company Registrar, Equiniti Limited, on 0371 384 2990.