Our purpose and strategy

Our purpose is Helping Britain Prosper.

2 September 2022

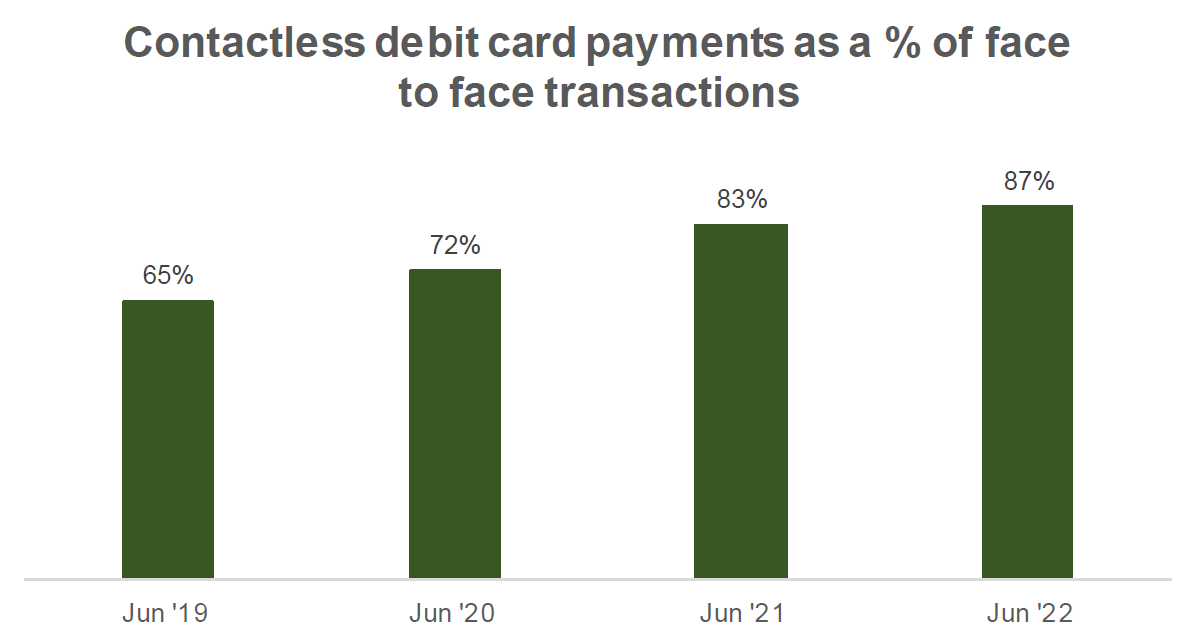

According to new data from Lloyds Bank, spend on debit cards made in person, using contactless technology, has grown from 65% to 87% in the last three years.

In April 2020 – during the pandemic – the contactless limit was increased from £30 to £45, rising to £100 in October 2021.

These higher limits have helped cement contactless as the preferred payment method of customers when out and about.

The rise in contactless payments as a preferred method has been driven by restaurant and health and beauty purchases, which both see around 90% of face to face card payments made with a tap of a debit card.

While all categories analysed see contactless as the main choice for debit card spending, this does start to tail off for retailers where the average purchase price is typically over £100 (and therefore contactless would not be available), such as furniture stores or electrical stores.

June 2022 |

Contactless as a percentage of face to face transactions |

|---|---|

June 2022Restaurant |

Contactless as a percentage of face to face transactions93% |

June 2022Health and beauty |

Contactless as a percentage of face to face transactions90% |

June 2022Department and online stores |

Contactless as a percentage of face to face transactions89% |

June 2022Supermarket |

Contactless as a percentage of face to face transactions86% |

June 2022Hardware |

Contactless as a percentage of face to face transactions85% |

June 2022Clothing |

Contactless as a percentage of face to face transactions80% |

June 2022Furniture |

Contactless as a percentage of face to face transactions77% |

June 2022Electrical |

Contactless as a percentage of face to face transactions68% |

June 2022Average retail |

Contactless as a percentage of face to face transactions87% |

In response to customer feedback, Lloyds Bank was the first bank to allow customers to choose their own contactless limit for spending, between £30 and £95, on a debit or credit card.

Since this feature was introduced in autumn 2021, 800,000 debit card customers have used it to freeze contactless payments, or choose an alternative limit.

Over half (60%) of debit card customers who have set their own limit have opted for one under £50.

A further quarter (25%) have set the highest bespoke limit of £95.

Gabby Collins, Payments Director, Lloyds Bank, said: “The convenience of a contactless payment is clear when you look at the growth in this type of payment over time, with 87% of face to face debit card transactions now made using the technology. We know how important choice is for customers, so our mobile app gives customers the option to set their own contactless limit, as well as turn the option on and off, and we’ve seen around 800,000 customers use the tool since we introduced it in 2021.”