Our purpose and strategy

Our purpose is Helping Britain Prosper.

5 October 2022

British teenagers say they go online for help on everything from hair hacks to video game tips, with one in three (33%) preferring to seek advice on the web to avoid the ‘awkwardness’ of asking someone face to face.

The Lloyds Bank research - which surveyed 1,000 kids aged 10-17 years and their parents – found that cooking, make-up advice and baking are the most common things teens will get tips about online. Others will look for help with their finances and sports skills and they will turn to TikTok or Instagram for revision tips and advice on applying for jobs.

However, for relationship advice, mum is still the first port of call. Dad is the go-to for health tips, homework and revising and, when it comes to exams, teachers are the favourite. The research also quizzed the teens’ parents and found that they also leaned heavily on their parents for advice.

For financial guidance, almost three fifths (58%) of youngsters believe their parents are best placed to give them advice on the topic; although nearly a quarter (22%) claim social media has helped them understand the value of money.

Moreover, the Lloyds Bank research also uncovered that some young people are struggling to open-up when it comes to talking about money. Just over a tenth (13%) said they needed advice on money or finances in the past 12 months but felt too awkward or embarrassed to bring it up with their friends and family.

Emma Abrahams, Head of Savings at Lloyds Bank, comments: “Although children are turning online first for advice on fashion and make-up, our research shows that parents are usually still the first port of call for financial advice.

We also found just over a third (38%) of children say they started to understand the value of money between the ages of 13 to 15, and 29% have learnt this from having their own bank account - highlighting it’s never too early for parents to start teaching their children good money habits. The Lloyds Bank Smart Start account gives young people a way to safely manage their money and build good savings habits, with oversight from parents.”

Lloyds Bank Smart Start offers a unique spending and saving account, designed to give those aged between 11 and 15 the freedom to start independently managing their own money. It gives parents an oversight of the account, displaying it alongside their own, within their online banking.

The research also found that almost two fifths (39%) of young people believe platforms such as Facebook and Instagram offer a quick and concise way to learn things, rather than having a face-to-face conversation with someone.

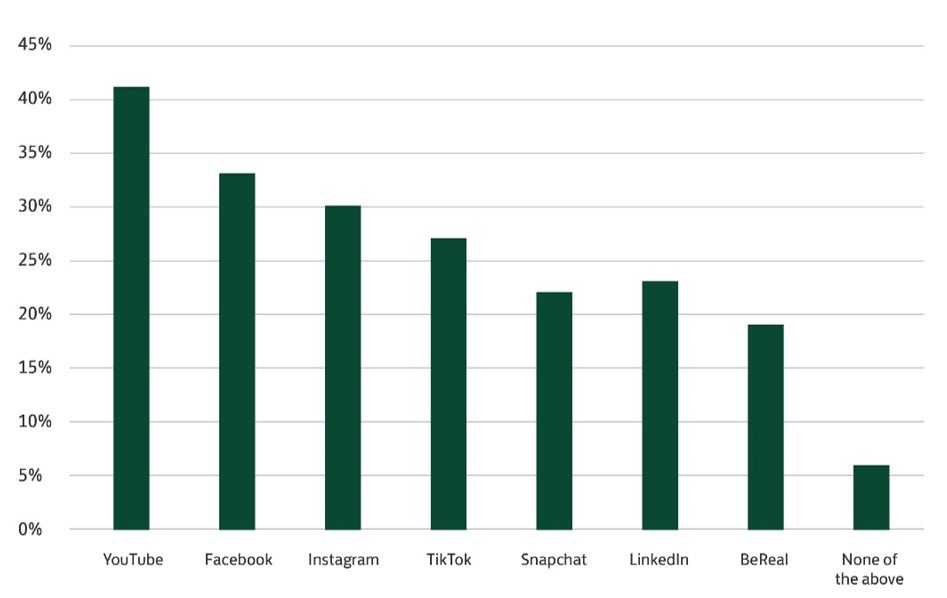

Children ranked their preferred online resources for all advice, with YouTube coming out on top:

Anna Mathur, bestselling author, psychotherapist, and mother of three, said: “In a world of next day delivery, instant online purchases and tap payments without receipts, we need to be more intentional about teaching our children good money habits. This means making sure that they’re receiving advice from trusted sources, whether that be online or from parents, friends and teachers.

"Our generation has seen the biggest shift in how we use, save and spend money - we remember cash only purchases, whereas our children may experience a future where physical cash or even plastic cards are a rarity. For this reason, it’s more important than ever to help our kids navigate the topic. Savings charts, pocket money, shopping lists and just generally talking about the world of finance with our kids are great ways to teach them about the value of money at a young age.”

Lloyds Bank is working with influencers across social media to demonstrate how older generations can inspire kids to be responsible with their finances through open communication both face-to-face and online.